Sustainable Governance

Risk Management

Billion Group establishes appropriate measurement methods for risks as the basis for risk management. After assessing and summarizing risks, appropriate response measures should be taken for the risks faced. In order to ensure the stable operation and sustainable development of Billion and serve as the basis for various risk management and implementation, it is planned to formulate risk management policies and procedures in 2023. The policies and procedures are in accordance with the "Regulations Governing Establishment of Internal Control Systems by Public Companies" issued by the Financial Supervisory Commission. Public companies are advised to establish appropriate risk management policies and procedures and establish an effective risk management mechanism to assess and monitor their risk tolerance, current risk tolerance, determine risk response strategies and compliance with risk management procedures.

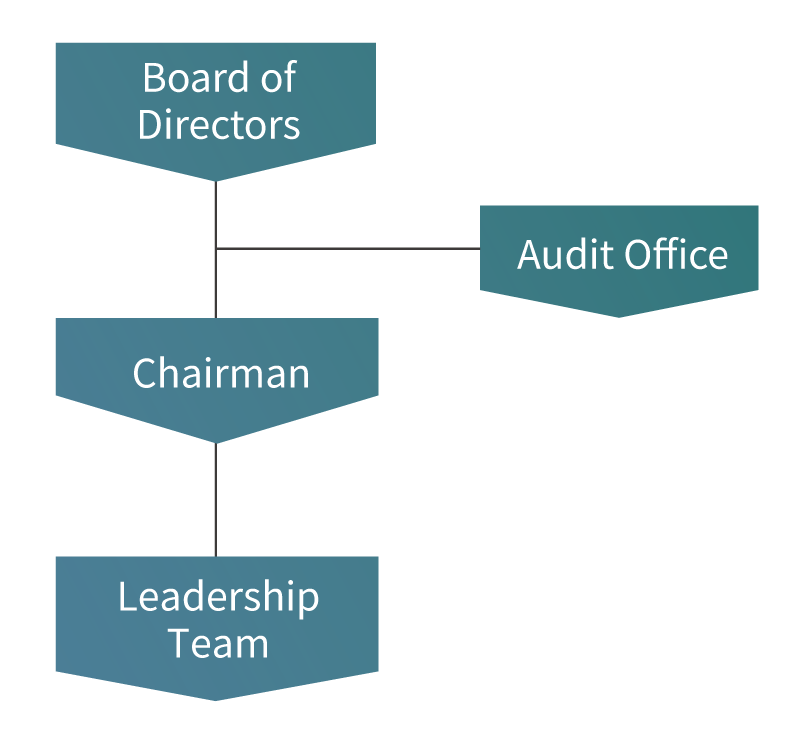

Risk Management Organization Structure

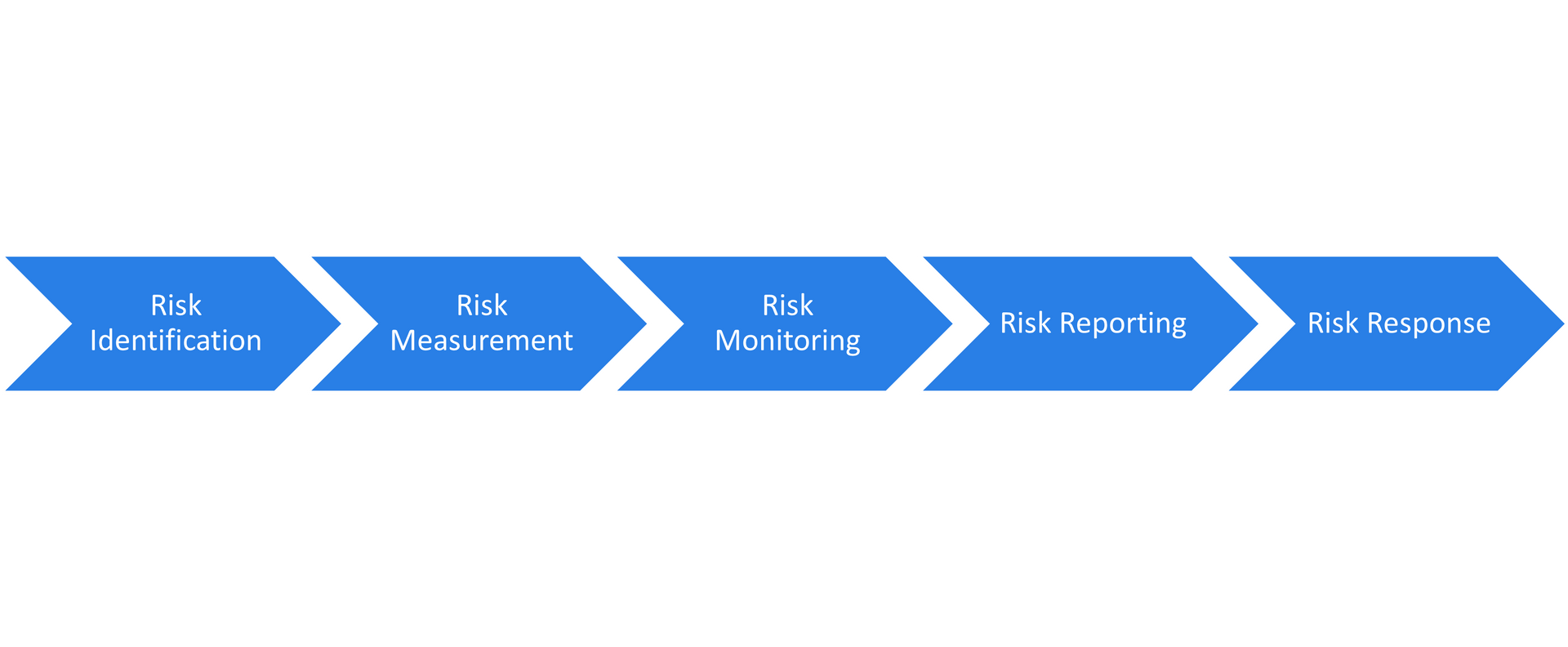

Risk Management Process