Corporate Governance

internal audit

Internal Audit Objectives

The purpose of internal auditing is to assist the board of directors and management in examining and reviewing deficiencies in the internal control system. It aims to measure the effectiveness and efficiency of operations, the reliability of financial reporting, and compliance with relevant laws. Additionally, it provides timely improvement recommendations to ensure the continuous and effective implementation of the internal control system.

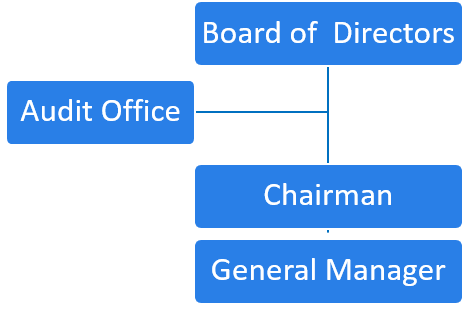

Internal Audit Organization and Structure

The internal audit unit of the company is under the jurisdiction of the board of directors. The audit committee reviews, appoints, and removes the head of internal audit with the board of directors approval. The hiring, termination, compensation, performance evaluations, rewards, and disciplinary actions for internal audit staff are carried out according to company regulations, and the audit head submits them to the chairman for approval. There is currently one audit supervisor and one auditor.

Internal Audit Organization and Operations

The audit unit formulates an annual audit plan based on the results of risk assessments, which includes the items to be audited each month. They execute audit operations in accordance with the annual audit plan to examine the company's internal control system. The board of directors approves the annual audit plan, and any revisions to it also require board approval.

Billion has established an audit committee composed entirely of independent directors. In addition to submitting audit reports to the audit committee members for review on a monthly basis, the head of internal audit also provides internal audit reports during quarterly audit committee meetings. If any audit report requires follow-up, it is tracked at least on a quarterly basis, and follow-up reports are generated after the issues are resolved to ensure that relevant units have taken timely and appropriate corrective actions. Communication between the audit committee members and the head of internal audit in the company must be in good standing.

Billion's certified public accountants report the results of the audit or review of the financial statements for the quarter, along with other required communications regarding legal compliance, during the quarterly audit committee meetings. The company's audit committee members must have good communication with the certified accountants.

Billion's internal audit staff has complete independence, executing their duties diligently from an objective and impartial standpoint. They ensure to act with the professionalism required and regularly report on audit activities to each independent director. Furthermore, the head of internal audit attends board meetings to report on the implementation status of the annual audit plan.

Billion and its subsidiaries conduct internal control system self-assessments at least once a year. The audit office reviews the self-assessment reports of various units and subsidiaries, as well as the improvements made in response to internal control deficiencies and anomalies identified by the audit unit. This serves as a key basis for the board of directors and the general manager to evaluate the overall effectiveness of the internal control system and issue the internal control system statement. Self-assessment reports and other relevant related documents are retained for at least five years.

In accordance with the deadlines stipulated by the Financial Supervisory Commission, the following matters are reported through the online information system in the prescribed format:

- Report the audit plan for the following year before the end of each fiscal year.

- Report the basic information of audit personnel and the hours of professional training received in the last fiscal year within one month after the end of each fiscal year.

- Report the implementation status of the annual audit plan for the previous year within two months after the end of each fiscal year.

- Submit the internal control system statement for the previous year within four months after the end of each fiscal year.

- Report the improvements made in response to internal control deficiencies and anomalies identified by the internal audit in the previous year within five months after the end of each fiscal year.